Table of Content

This ensures that he/ she can repay the loan amount effortlessly without defaulting. Failing to meet the eligibility criteria may lead to rejection of the loan application, leaving a negative mark on the individual’s credit profile. So, ensure to complete the processing faster and smoothly by fulfilling the required eligibility criteria. Lenders will also use this calculation to find a loan option that allows the borrower to make up to 3 times the required monthly repayment amount. Lenders determine loan eligibility depending on someone’s income and repayment capacity. They would like that the recommended EMI be between 50% and 60% of their net monthly income.

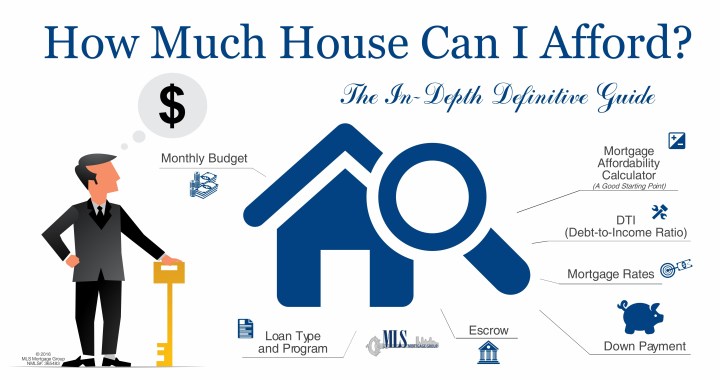

The weekly median earnings for full-time wage or salary workers in the United States in the second quarter of 2021 amounted to $990. The next step is to reach out to our team of top-notch mortgage lenders and get started on securing yourself the perfect deal. Joe and Anne Anderson have been saving hard for a deposit, and they want to know how much house they can afford.

Home Loan Interest Rates 2022

CIBIL prepares a report based on the entire credit history of the borrower. Banks, NBFCs, and Housing Finance Companies provide Home Loans to customers at affordable interest rates. The most important thing that makes Home Loan one of the cheapest loans in India is its affordable interest rates. To assess your financial records, lenders usually use three major credit reference agencies .

While there are other CRAs, these are most preferred by lenders across the UK. Out of the three, Equifax is the largest credit reference agency used by most lending institutions. Banks and real estate agents make more money when you buy a more expensive home.

How much should I spend on a car if I make $60000?

If you are one among them who want to realize your dream of buying a home, you will learn how the eligibility for a home loan is calculated. The loan amount you are eligible for depends on various factors such as your present age, monthly income, financial obligations, credit score, employment status and credit history. Individuals can easily check their home loan eligibility criteria on the official website of their preferred lending institution. Although most key requirements are usually the same, certain eligibility criteria may differ from lender to lender.

ITR – When you apply for a personal loan as a self-employed, it is mandatory to have filed an ITR of minimum 2 years. However, some banks and finance companies may require you to submit ITRs of minimum 3 years. Just note that to qualify for a 3%down conventional loan, most lenders require a credit score of at least 620 or 640.

What is an eligibility calculator for a home loan?

A guarantor is a family member or friend who provides additional security to a loan with the equity they have accrued through owning a home or property. Guarantors are responsible for paying back the loan amount if the borrower defaults on their repayments. The act of paying out money for any kind of transaction is known as disbursement. From a lending perspective this usual implies the transfer of the loan amount to the borrower. It may cover paying to operate a business, dividend payments, cash outflow etc. So if disbursements are more than revenues, then cash flow of an entity is negative, and may indicate possible insolvency.

Using the simple mortgage calculator on this page they sit down to work it out. Our existing customers enjoy special privileges such as pre-approved loans. Fill out basic contacts details and enter the OTP to see what you’re eligible for. Your minimum take home salary should be 25,000 per month to be eligible for Bajaj Finserv home loan. Check your eligibility using Bajaj Finserv’s Eligibility Criteria and avail a feature-rich Home Loan to finance your property purchase.

Home loan eligibility based on age

Your application is processed instantly so you can plan your finances better. If you have some income from other sources such as rent or investment, submitting proof of such income can increase your eligibility for a higher loan amount. If you opt for a longer tenure, you can reduce your monthly EMIs and increase your eligibility. It’s quite easy and simple to use the Eligibility Calculator provided by Bajaj Finserv.

An overdraft is a loan provided by a bank that allows a customer to pay for bills and other expenses when the account reaches zero. For a fee, the bank provides a loan to the client in the event of an unexpected charge or insufficient account balance. With a salary of ₹ 24,000, the maximum amount he is eligible for is ₹ 5.89 Lakh. The interest he has to pay for this amount for 72 months is 9.60%. With a salary of ₹ 18,000, the maximum amount he is eligible for is ₹ 3.75 Lakh. Your salary is the most crucial factor for a lender to gauge your loan eligibility and terms.

With a 20% down, this reduces your principal loan amount to $260,000. Instead of looking at the monthly transportation costs, Dave recommends buying cars that do not exceed 50% of their annual income. So if you make $ 50,000 a year, you should not spend more than $ 25,000 on a car . Borrowers are not required to pledge any security or asset against the loan amount. The approval process is quick and easy and requires minimal documentation.

Hero FinCorp Instant Personal Loan is one of the latest personal loan apps helping with instant loans within 24 hours. Get the Hero FinCorp Instant Personal Loan app on your phone. Individuals applying for first-time loans or those with a minimum monthly income of INR 15,000 can also apply for an instant loan on the Hero FinCorp Instant Personal loan app.

No comments:

Post a Comment